Remortgage borrowing calculator

Where can I get mortgage advice. For a further advance transfer of equity porting with additional borrowing and any post contract variation this calculator should be.

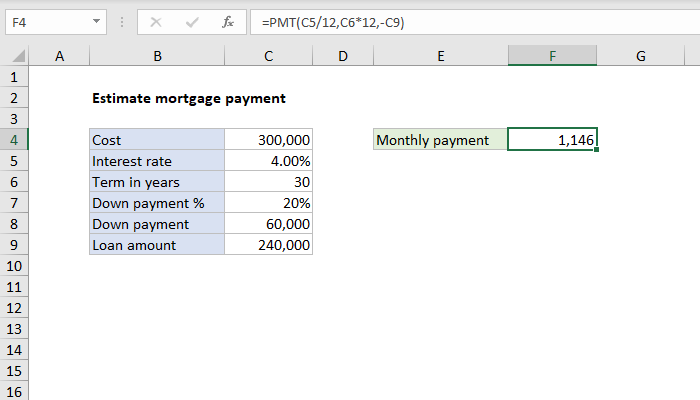

Excel Formula Estimate Mortgage Payment Exceljet

Remortgage to save money.

. When applying for a remortgage on a like for like basis the calculator will return the affordable amount subject to a maximum of the amount transferred from the existing lender plus 1000. Buy-to-let calculator see if we could lend you the amount you need for a property youll rent out. Use our borrowing more calculator to see if this is the right option for you.

For BTL Purchase or LTB the anticipated rental income will automatically be included in customers income for calculation purposes. Mortgage fees and charges. Borrowing is a normal part of life for millions in the UK many of us need to borrow at some point to fund a major purchase whether it be a.

The main reason for remortgaging is to save money - you can save an average of 300 per month by switching to a better deal² If youre on a fixed rate mortgage once. Borrow more on your Royal Bank of Scotland residential mortgage to help realise your plans for those home improvements dream holiday etc. The remortgage market is more competitive amongst lenders than the first-time buyer FTB market.

92 Home purchase mortgages. To use our mortgage interest calculator simply enter a few details about your mortgage. Use our affordability calculator to provide an accurate borrowing figure before you begin your application.

Application type Maximum LTV. Lenders charge early repayment fees because theyre expecting to make a certain amount of interest by lending to you on a fixed or tracker rate deal so paying off your mortgage earlier means theyve lost. Buy to Let Remortgage.

See if the costs of ditching are worth it. Or 4 times your joint income if youre applying for a mortgage. The outstanding balance plus any extra youre borrowing along with the term length remaining and your current interest rate to get your.

How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. Remortgaging is a great way to save 1000s a year. Remortgage calculator Buy to let mortgages 95 mortgages Equity release Equity release calculator Stamp duty calculator Credit cards 0 Balance transfer cards Credit builder cards 0 New purchase.

Early repayment penalty charges can also be applied if you want to pay off a chunk of your mortgage to reduce your overall borrowing. Use our offset calculator to see how your savings could reduce your mortgage term or monthly payments. Buy to Let Remortgage no equity release Let to Buy.

So only around 12 in that category opted for strongly dominated product choices. Affordability calculator get a more accurate estimate of how much you could borrow from us. For a thorough calculation of how much your client may be able to borrow fill in the full affordability calculator below.

Review Irish mortgage news and rates. If it doesnt youre free to remortgage at any time. Browse through interactive calculators and apply online.

Back in 2002 we were the first mortgage advisers to provide an online mortgage comparison between lenders in Ireland. Check if yours has one. Youll need to know your loan amount and your mortgage term.

This calculator is for guidance purposes only. Mortgage Company of Ireland - Mortgagesie. You could potentially in some circumstances borrow up to a maximum of 90 of the value of your home.

Put simply a mortgage is a type of loan to buy or refinance a property. All applications are subject to lending policy and product availability. A full Illustration is available on request or online.

We are pleased to have introduced the new Finance Ireland mortgage rates to our calculator and we will add Avant Mortgage rates shortly. Many mortgages have an early repayment charge for the initial incentive period. You can work out what your mortgage payments will be after you port your loan to your new home by using our mortgage porting calculator below.

Use our remortgage calculator by entering information about your current mortgage to find new deals to suit your needs. Learn more on our how do mortgages work webpage. Simply tell us about your current mortgage to see if remortgaging to us is the right option for you.

Existing customer PPI information. Our trained mortgage advisors can help you on your home buying journey over. Affordability calculator This calculator is for new business purchase and remortgage applications only.

Offset calculator see how much you could save. About 18 of first-time buyers fall into the strongly dominated product choice category and well over 20 of mover mortgages fall in this category. Our remortgage calculator is designed to show you our mortgage deals which might suit your needs better.

Full Rental Income Calculator - Calculate the maximum amount of capital your client can borrow to purchase their property based on their annual income. This Money Saving Expert guide tells you how it works when you should remortgage and why you shouldnt. Any amount we agree to lend is subject to a full mortgage application.

Second property or buy to let property 85 LTV. Mortgages and remortgages and Mortgage protection in Ireland. Use our mortgage calculator to compare mortgage rates from lenders.

If you want to borrow more on your mortgage you can calculate some costs here. Find out what you can borrow. Additional borrowing on existing BM Solutions mortgage.

Ditch my fix calculator. It takes about five to ten minutes. Weve set the current interest rate and predicted change to rates we think are realistic but you can change this to suit you.

Youll need your mortgage account number to hand. Rate Change Calculator - Find out how your customers mortgage repayments will be affected by a change in the Bank on England base rate. If you remortgage during this period youll trigger the charge and its usually thousands of pounds the equivalent of up to 5 on the outstanding mortgage balance.

Youll need your mortgage account number to hand. Remortgage with additional mortgaged properties in the background eg. Borrowing 1000 at 5 over 20 years is more than twice as expensive as 10 over 5 years.

Remortgage for debt consolidation or paying off a second charge including non Help to Buy equity loans. THIS SITE IS INTENDED FOR THE USE OF UK MORTGAGE INTERMEDIARIES AND PROFESSIONAL ADVISORS ONLY. Input the total mortgage amount to be ported ie.

It is not an offer of a mortgage. Use our Remortgage calculator and find a deal to suit your needs. Remortgage like-for-like and with additional borrowing.

Interest Only Mortgage Calculator And Guide Mortgage Calculators

Home Mortgage Payment Calculator Using An Excel Spreadsheet

How Much Can I Borrow Calculator Mortgage Calculators

Mortgages Calculators

Download Free Excel Mortgage Calculator And Comparator Spreadsheet

Home Loan Calculators And Tools Hsh Com

Reverse Mortgage Calculator Reverse Mortgage

Extra Payment Mortgage Calculator For Excel

How Much Mortgage Can I Afford Nerdwallet Uk

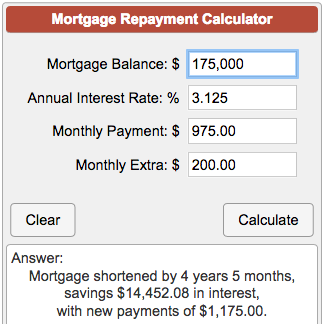

Mortgage Repayment Calculator

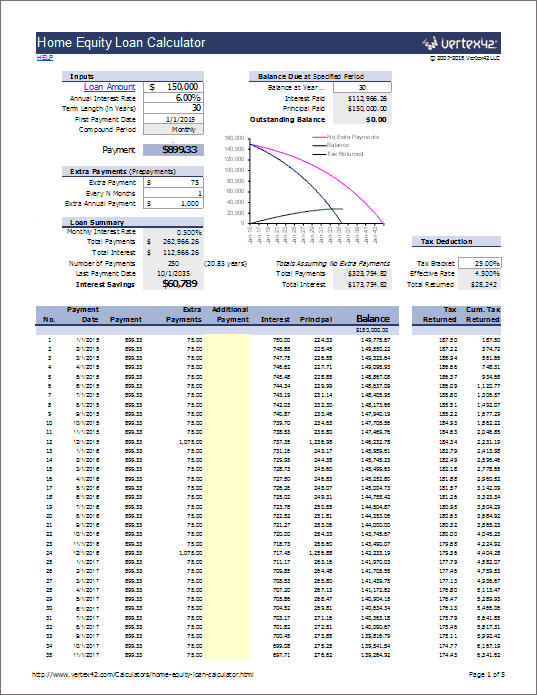

Home Equity Calculator Free Home Equity Loan Calculator For Excel

What You Need To Know About Mortgage Calculators In 2022

6 Ways To Improve Your Odds Of Getting A Home Loan Zillow

Mortgages Calculators

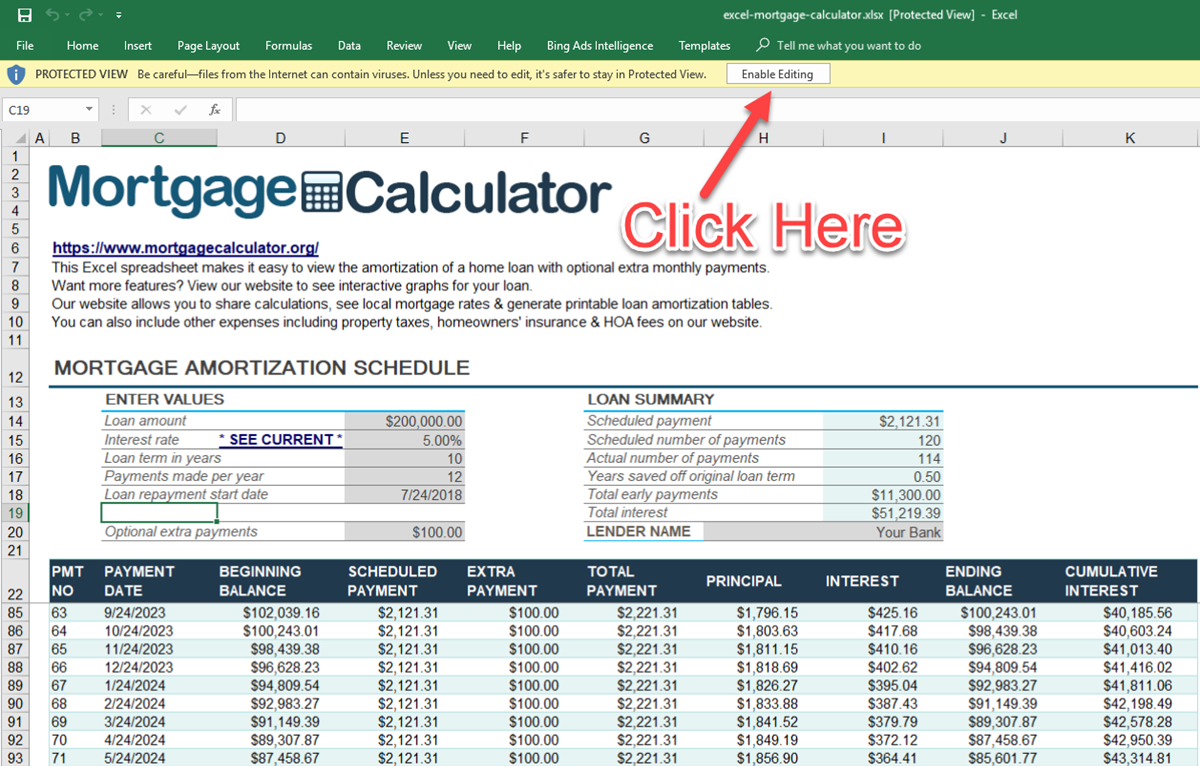

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Download The Mortgage Payoff Calculator With Line Of Credit From Vertex42 Com In 2022 Mortgage Payoff Pay Off Mortgage Early Mortgage Amortization Calculator

Mortgage Calculators Uk Natwest Mortgages